MOHELA Student Loan Guide 2025 – Login Eligibility and Application Process

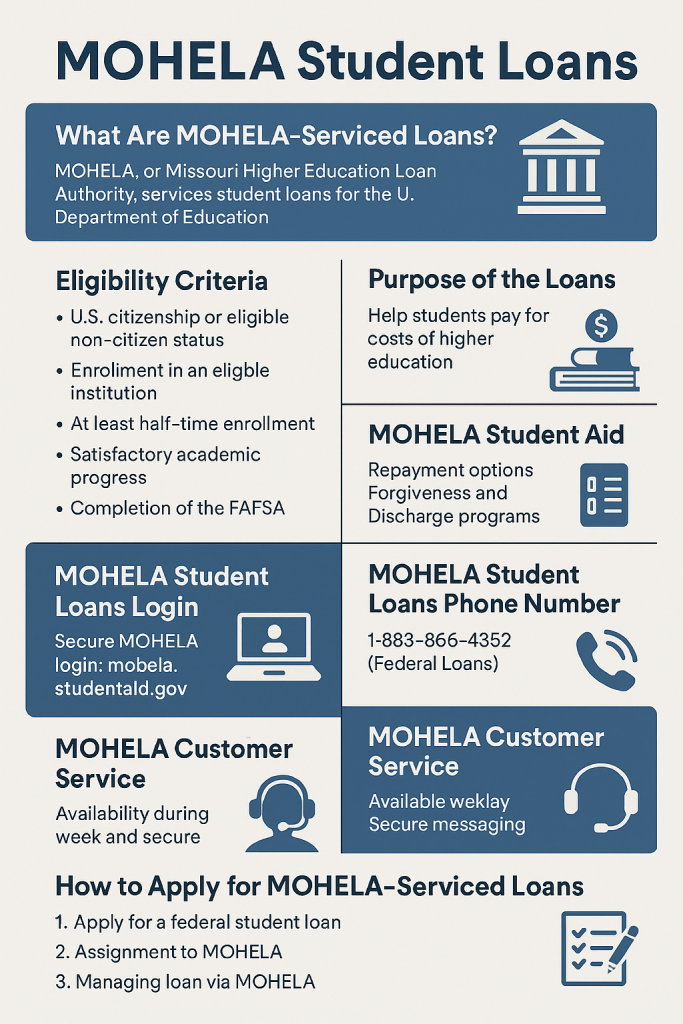

MOHELA stands for Missouri Higher Education Loan Authority. It is a quasi-governmental organization based in Missouri that works as a student loan servicer in the United States.

It’s important to clarify: MOHELA does not issue new student loans itself (in most cases). Rather, it services federal student loans on behalf of Federal Student Aid (FSA), U.S. Department of Education.

In past years, MOHELA also participated in servicing certain FFELP (Federal Family Education Loan Program) loans.

In essence, if you have a federal student loan (Direct Loan, or others that have been assigned to MOHELA), MOHELA becomes your point of contact for managing that loan payments, inquiries, repayment options, etc.

Check Also: Food Packaging Jobs 2025 in Dubai With Visa Sponsorship

Eligibility Criteria & Purpose of MOHELA-Serviced Loans

Purpose of the Loans

These are federal student loans originally made (or guaranteed) under U.S. federal student aid programs. The goal is to help eligible students cover the costs of higher education (tuition, fees, living expenses, books, etc.) when their personal/family finances or other aid do not fully cover them.

Because MOHELA is a servicer, not the lender, its role is to administer the repayment, servicing, and customer support functions for these loans.

Eligibility Criteria (for the Underlying Federal Student Loans)

Since MOHELA is just a servicer, the eligibility rules are set by the federal student aid programs, not by MOHELA itself. But here are the typical eligibility requirements for federal student loans:

- U.S. citizenship or eligible non-citizen status

- Valid Social Security number (in most cases)

- Enrollment in an eligible institution (a school that participates in federal student aid)

- Enrollment at least half time (for many loans)

- Not defaulted on prior federal student loans

- Satisfactory academic progress

- Completion of the Free Application for Federal Student Aid (FAFSA)

- Credit checks (for PLUS or GradPLUS loans)

If you meet those criteria and you borrow a federal student loan, your loan may be assigned to a servicer like MOHELA for ongoing management.

MOHELA Student Loans Login

To manage your student loans that MOHELA services, you’ll need to access their online portal:

- Secure MOHELA Login: You can log in via mohela.studentaid.gov (for federal student loans) or via an MOHELA servicing site.

- The login page typically asks for Username and Password.

- If you forgot your username or password, there are options to recover them (e.g. “Forgot Username or Password”) on the login screen.

- Once logged in, you can view your loan balances, payment history, accrued interest, and manage your repayment plan and contact preferences.

Make sure to allow 24–48 hours after the assignment of your account to MOHELA for your online access to become active.

MOHELA Student Aid & Assistance

Though MOHELA itself isn’t a lender, it offers a suite of aid, servicing, guidance, and tools to borrowers of the federal student loans it manages.

- Repayment Options

MOHELA supports multiple repayment plans for federal loans, including:- Standard Repayment

- Graduated Repayment

- Extended Repayment

- Income-Based Repayment (IBR) or other income-driven plans

These help borrowers manage payments more affordably depending on their income or loan balance.

- Loan Forgiveness & Discharge Programs

If eligible, borrowers may qualify for programs like:- Public Service Loan Forgiveness (PSLF)

- Teacher Loan Forgiveness

- Disability Discharge

- Closed School Discharge

- Death Discharge

MOHELA handles servicing tasks related to these programs for the federal loans it services.

- Customer Tools & Self-Service

- Secure messaging to MOHELA via the portal

- Ability to upload documents

- Online payments, auto-pay setup

- Notifications, alerts, and managing contact preferences

- Educational resources and FAQs on loan management

- Support During Hardship

MOHELA also offers options such as deferment, forbearance, and rate reduction programs where applicable (especially for private loans serviced by MOHELA) to help borrowers facing financial hardship.

MOHELA Student Loans Phone Number & Customer Service

If you need to speak with MOHELA directly, here are the primary contact details and customer service information:

- General (Federal Direct Loan Servicing): 1-888-866-4352 (toll free)

- International: 636-532-0600

- For PLUS/FFELP or other specific loan types (commercial or FFEL servicing): 1-800-945-4701

- Private student loans serviced by MOHELA: 1-888-272-5543 (toll free) for servicing inquiries

- PSLF (Public Service Loan Forgiveness) inquiries: 1-855-265-4038

- Military / Servicemembers: 1-855-278-3619

- TTY / TDD users: Dial 711 via the U.S. (for direct loan servicing)

Hours of Operation (for Direct Loan Servicing)

MOHELA’s hours vary by day (Eastern Time):

- Monday: 8 a.m. – 11 p.m. ET

- Tuesday, Wednesday, Thursday, Friday: 8 a.m. – 8 p.m. ET

- Saturday: 10 a.m. – 2 p.m. ET

Note: Payment and automated account info are available 24/7 through their phone system.

You can also send secure messages through your online account portal.

How to Apply for MOHELA-Serviced Loan

Because MOHELA is a servicer, not the original lender in most cases, “applying” for a MOHELA loan is not the correct concept. Instead, this is the typical process:

- Apply for a federal student loan

- Fill out the Free Application for Federal Student Aid (FAFSA).

- Your school or the Department of Education will determine eligibility and award a federal student loan (e.g., Direct Subsidized, Direct Unsubsidized, PLUS).

- You sign a Master Promissory Note (MPN) agreeing to repay.

- Assignment to a servicer

- After the loan is made, federal student loans are assigned to a servicer (one among several contracted by the U.S. Department of Education).

- If MOHELA is assigned, you will receive notice that MOHELA will service your loan.

- Once assigned, your loan details will appear in your MOHELA (or Federal Student Aid) online account, and you can begin servicing through MOHELA.

- Managing your loan via MOHELA

- Log in to your MOHELA or Federal Student Aid portal

- Choose or change repayment plans

- Make payments

- Submit documentation or inquiries

- Enroll in auto-pay or select deferment/forbearance if eligible

In summary: you don’t apply to MOHELA. Instead, your federal student loan is assigned to them, and then you use their services to manage the loan.

Conclusion

MOHELA plays a critical role in the U.S. student loan ecosystem as a servicer for federal student loans (and some private loans). While it doesn’t issue new loans in most cases, it is your primary point of contact for managing repayment, applying for forgiveness or discharge, and addressing customer service needs. Knowing how to log in, who to call, and which programs are available can help you manage your student debt more effectively.

If you’re a borrower whose loans are serviced by MOHELA, keep your account active, monitor your statements, re-certify income-based plans on time, and proactively reach out if you run into trouble. This ensures you stay on track and avoid unnecessary costs or penalties.

Frequently Asked Questions (FAQs)

Q1: Can MOHELA refuse to service my loan?

No, you don’t choose your servicer. The U.S. Department of Education assigns servicers like MOHELA to manage federal student loans. If your loans are assigned to MOHELA, they must service them under federal regulations.

Q2: Do private student loans also go through MOHELA?

Sometimes , MOHELA also services certain private student loans, in which case they handle repayment, forbearance, rate reduction, etc., under the terms of the private loan.

Q3: What happens if I don’t repay on time?

Missed payments may lead to delinquency and default, additional fees, negative credit reporting, and loss of eligibility for certain repayment or forgiveness programs. Use deferment/forbearance options when needed, but interest may continue to accrue.

Q4: Can I change repayment plans after my loan is with MOHELA?

Yes — using your MOHELA/Federal Student Aid account, you can apply for different repayment plans (standard, graduated, income-based, etc.), subject to eligibility.

Q5: How do I qualify for Public Service Loan Forgiveness (PSLF)?

You must make 120 qualifying payments while working full-time for a qualifying public service employer, and your loans must be under a qualifying repayment plan. MOHELA administers the PSLF servicing for many borrowers.

Q6: What if I can’t pay due to financial hardship?

You may apply for deferment or forbearance, or choose an income-driven repayment plan. MOHELA supports these options where they apply.

Q7: How can I contact MOHELA if I have an issue?

Use the toll-free numbers (1-888-866-4352 for Direct Loans, or 1-888-272-5543 for certain private loans) or contact them via secure message in your online portal.

Q8: Are there complaints or issues borrowers face with MOHELA?

Yes. Some borrowers have reported billing delays, misprocessing, difficulty reaching live representatives, or errors in applied payments. These have led to scrutiny and even fines by the Department of Education.